Brenda Kinnear

Brenda Kinnear

"No man is an island entire of itself; every man

is a piece of the continent, a part of the main..."

- John Donne

A little dramatic perhaps but a reminder that the Vancouver real estate market is not lived in isolation from the rest of the world. Although August is usually a sunny lazy break in the business of the year with modern communications it is impossible to escape from all that is happening outside our bubble. There are changes and drama everywhere that will impact how the rest of the world views a safe haven in Vancouver.

Canada itself offers what the British Empire offered...the rule of law. Also tolerance and acceptance in general. This attracts buyers from all over the world. Many are choosing Vancouver for a second home purchase so they can holiday in a beautiful, safe and inclusive place. Most offshore buyers have the financial resources to pay the provincial taxes levied against them. At the moment they are buying holiday homes in locations where the Foreign Buyer Tax is not applied, notably Whistler.

Robson Street by Colin Knowles

Taiwanese nationals were one of the 90s waves of immigrants to Vancouver. Their children were educated here, many adults took out Canadian citizenship and then returned home. We are now hearing anecdotally of Taiwanese-Canadian citizens returning to Canada because they don’t like their government and the threats against Taiwan from China who considers it their province, not an independent country.

So no matter if we are in a period of adjustment in the real estate market the location, climate, restricted land mass surrounded by ocean, mountains and the ALR of the Lower Mainland will always attract buyers. Prices may adjust off their astronomical highs but there still will not be the affordable housing that so many wish for. The government is trying to create more housing in urban areas by taxing local residents, foreign residents, out of province Canadian residents and causing a backlash from all the municipalities. The taxes are applied in an uneven fashion and Canadians are advocates for fairness. We shall have to see how the government is going to adjust its taxation program. Real estate related activities have provided more than 25% of the provincial GDP and real estate revenues for the government are plunging.

There was an interesting article in the Financial Post on the urgency of building rental housing in Vancouver and Toronto. The Haider-Moranis Bulletin offered some creative ideas including facilitating joint ventures between entrepreneurial developers who are looking for short-term returns, and institutional investors who are in it for the long haul. There was a discussion of building condo style rental buildings to attract long term millennial and downsizing senior renters. It referred to the deleterious effects on rental construction of rent controls as applied in Ontario. BC got rid of rent controls years ago so we are more set up for new ways to do things.

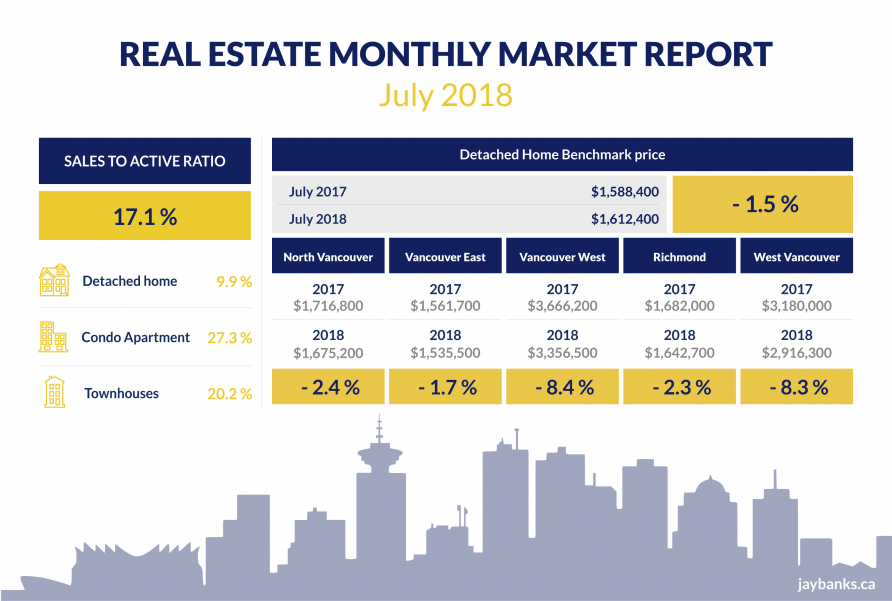

We can see that the slowdown in detached home sales has impacted every other type of housing. There was a controversial article in the Vancouver Sun giving a worm’s eye view of the detached housing market. Stuart Bonner who is quoted in the article is a highly regarded colleague and uber-successful Westside realtor. It gives an insight into how the recent slowdown is impacting the market in general. Despite the comments within it is clear that Benchmark prices give a more reliable trend line than using median sales prices that depend on too many individual components.

We can’t forget that the mortgage rules and stress test are also a huge factor in the changing market conditions. They have hammered all buyers since they instituted a stress test for buyers who have 20% down and would normally qualify for a favourable mortgage rate.

Townhomes are desirable to downsizing buyers but the drop in the numbers of sales of detached homes has put many buyers plans on hold. Sales numbers are down 34,8% from July 2017, The benchmark price across the region is $856,000, a 12.1% price increase compared to July 2017.

Condominiums which were the choice of first time buyers last year have been heavily impacted by the mortgage stress test and the 13.6% price increase from July 2017. The regional benchmark price is $700,500.

"Summer is traditionally a quieter time of the year in real estate," as stated by Phil Moore President Real Estate Board of Greater Vancouver. "This is particularly true this year. With increased mortgage rates and stricter lending requirements, buyers and sellers are opting to take a wait-and-see approach for the time being."

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of inventory.

In July 2018 the benchmark price for an apartment property across the region was $700,500. This was a 13.6% increase from July 2017.

In July 2018 the benchmark price for a condo apartment in North Vancouver was $599,400 up 10% in one year, up 67.4% in 5 years and up 68.6% in 10 years.

In Richmond the condo benchmark price was $683,600 up 17.4% in one year, up 91.5% in 5 years and 96.2% in 10 years.

In Vancouver East the condo benchmark price was $568,900 up 8.4% in one year, up 85.6% in 5 years and up 92.1% in 10 years.

In Vancouver West the condo benchmark price was $835,200 up 6.6% in one year, up 75.4% in 5 years and up 87.3% in 10 years.

In West Vancouver the condo benchmark price was $1,234,200 up 8.5% in one year, up 70.4% in 5 years and up 69.3% in 10 years.

More anon.

DT00SS