Brenda Kinnear

Brenda Kinnear

"Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window."

– Peter Drucker

It appears we are in Biblical (Genesis 41:27) times indeed. Unfortunately none of us believed Pharoah’s dream of seven fat years followed by seven lean years. Seven years of great prosperity followed by seven years of loss. Human nature has not changed much in the thousands of years that have passed since then. We believe that the good times will roll on forever despite the cyclical nature of real estate sales and price points. Canada is fortunate in that the prophecy of a soft landing for real estate seems in the process of being fulfilled.

In Vancouver, the drop in sales numbers and a slight rollback in prices contrast with good times in Toronto despite the fact that the Mortgage Stress Test is a federal regulation and applies across the country. According to the Financial Post taxes push luxury home sales down by 35%. In Vancouver buyers are choosing to invest in smaller luxury condos between $1- 2 million rather than buy an old house for the same price. Condo sales rose 6% over the past year. Detached home prices in Metro Vancouver are heavily hit by taxes and regulations set by the NDP-Greens government plus the empty homes tax enforced by Vancouver City Council. Provincial regulations include a raised foreign buyer tax, a speculation tax, a school tax on homes over $3 million. Locals are buying smaller city condos and Chinese money is staying home.

The mortgage stress test is pushing buyers to the unregulated mortgage market. Private lenders don’t have to comply with the federal lending rules. There is Bank of Canada concern for the high amount of household debt in Canada but there is little information available as to how much debt is being created by mortgages that are not issued by a major bank.

A little slice of peace by Reva G

According to the Vancouver Sun it appears that younger home owners have great confidence in their investment over the long term. They believe it will go up in value more than a stock portfolio despite a recent slowdown in sales. Sotheby’s has been gathering data on the generation aged 20-45 years that will inherit the baby boomer wealth and how this generation views real estate. According to Sotheby’s surveys it covers about 9 million people. Enough to make a big difference in the long term.

Although sales in general are down substantially in number it appears that like all dramatic changes people get used to them. There is a return to the Westside for condo choices. The slight drop in price has attracted buyers who prefer those neighbourhoods. The sales of detached homes has been devastated by the above-mentioned taxes and offshore investor concerns around disclosure. The affordability gap is wider than ever and is not solved by political posturing.

Overall it is a time of great opportunity in the housing market. Vancouver is never down for long.

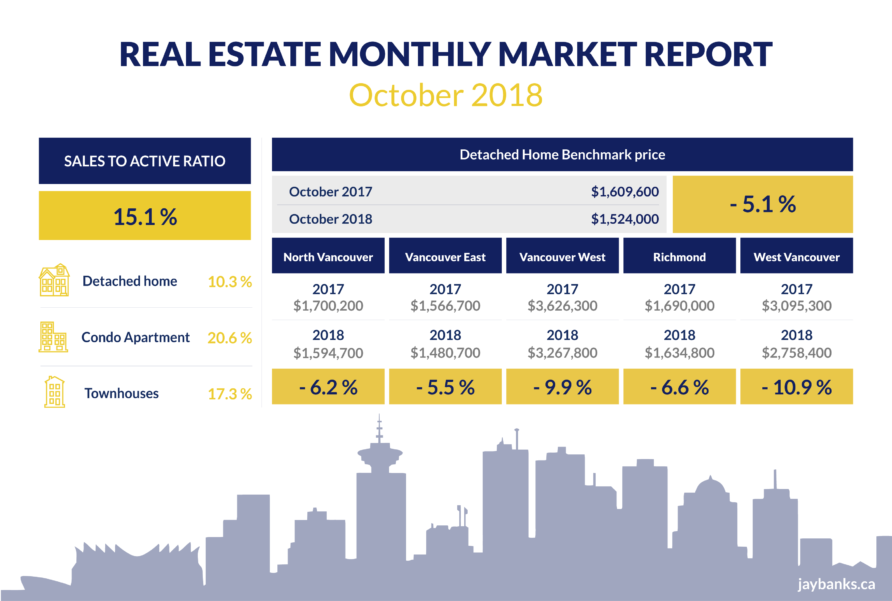

Detached homes sales have declined 32.2% compared to October 2017. The detached benchmark price across the region is $1,524,000, a 5.1% decrease from October 2017. This includes a 3.9% decrease over the past 3 months.

Townhomes are desirable to downsizing buyers but the drop in the numbers of sales of detached homes has put many buyers plans on hold. Attached sales numbers are down 37.5% from October 2017, The benchmark price across the region is $829,200, a 4.4% price increase compared to October 2017. This includes a 3.1% decrease over the past 3 months.

Condominiums which were the choice of first time buyers last year have been heavily impacted by the mortgage stress test and the 5.8% price increase from October 2017. Apartment sales numbers are down 35.7% from October 2017. The regional benchmark price is $683,500. This includes a 2.8% decrease over the past 3 months.

"Home prices have edged down between three and five percent, depending on housing type, in our region since June," as stated by Phil Moore President, Real Estate Board of Greater Vancouver. "This is providing a little relief for those looking to buy compared to the all-time highs we’ve experienced over the last year."

The sales to active listing ratio for October 2018 is 15.1%. By property type, the ratio is 10.3% for detached homes, 17.3% for townhouses, and 20.6% for condominiums.

In October 2018 the benchmark price for a detached in North Vancouver was $1,594,700 down 6.2% in one year, up 65.6% in 5 years and up 91.3% in 10 years.

In Richmond the detached benchmark price was $1,634,800 down 6.6% in one year, up 69.4% in 5 years and up 118.7% in 10 years.

In Vancouver East the detached benchmark price was $1,480,700 down 5.5% in one year, up 74.3% in 5 years and up 135.6% in 10 years.

In Vancouver West the detached benchmark price was $3,267,800 down 9.9% in one year, up 56.5% in 5 years and up 127.3% in 10 years.

In West Vancouver the detached benchmark price was $2,758,400 down 10.9% in one year, up 44.5% in 5 years and up 94.8% in 10 years.

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of affordable inventory.

In October 2018 the benchmark price for a condo apartment in North Vancouver was $582,000 up 3.0% in one year, up 61.7% in 5 years and up 71.8% in 10 years.

In Richmond the condo benchmark price was $681,900 up 9.3% in one year, up 84.8% in 5 years and 101.6% in 10 years.

In Vancouver East the condo benchmark price was $569,100 up 5.7% in one year, up 85.5% in 5 years and up 102.5% in 10 years.

In Vancouver West the condo benchmark price was $809,600 up 0.4% in one year, up 73.3% in 5 years and up 89.3% in 10 years.

In West Vancouver the condo benchmark price was $1,157,200 down 0.5% in one year, up 61.9% in 5 years and up 74.5% in 10 years.

More anon.

BR00CR